Analytics, Baltic Export, Baltic States – CIS, Direct Speech, Economics, EU – Baltic States, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Friday, 19.04.2024, 05:42

Who are the major losers of Russian sanctions?

Print version

Print versionWho will pay the price?

Of

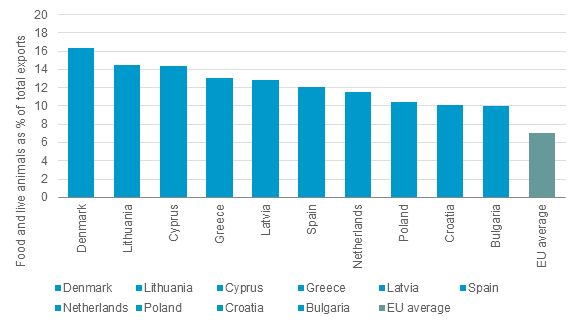

those facing the ban, the EU has the closest trade ties with Russia. Russia was

the destination for 2.6% of EU exports in 2013. This ranges from just 0.4% in

Portugal, to a hefty 19.1% in Lithuania. Of those facing sanctions, the

countries’ most dependent on agricultural exports (in terms of the proportion

of their exports which are composed of food and live animals) are Denmark,

Lithuania and Cyprus.

|

| Top 10 Agricultural Exporters: 2013 |

Source: Euromonitor International from United Nations (UN), International Merchandise Trade Statistics

Note: Based on a ranking of those countries affected by the sanctions – the EU, Canada, Australia and the USA.

Lithuania, as an important agricultural exporter and a major trading partner of Russia, is the chief country in the firing line. Its major agricultural exports to Russia in 2013 were vegetables, fruit and nuts, and dairy products and eggs – many of which are included in the export ban. Food and drink exports from Lithuania to Russia totalled US$1.8 billion in 2013, equivalent to 28.2% of all exports to Russia in that year.

An added risk to the EU economy

The

EU’s exports of food and agricultural products to Russia totalled US$15,463

million in 2013 or 9.7% of its total exports to Russia, which represents 0.1%

of GDP. Therefore the direct impact on the EU economy taken as a whole will not

be large. Yet the sanctions must be seen in the wider context of a weak Russian

economy and the heightened risks that geopolitical instability in Ukraine and

the worsening of relations with Russia bring to the EU at a time of already

fragile growth.

An own-goal for Russia

The sanctions could also be something of an own-goal for Russia. Russia is a food importer with a trade deficit in food, live animals and beverages of US$23,878 million in 2013; and the ban on EU products could push up inflation, already high at 6.8% in 2013. Russia will have to ramp up domestic agricultural production and seek new suppliers of food products, which will necessarily be further afield, adding costs to imports. Again this must be seen in the wider context of a weak Russian economy facing low levels of investment, weak business confidence and significant capital outflows.

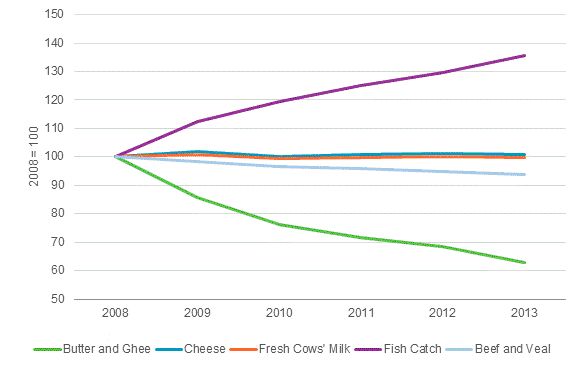

|

| Russian Production of Selected Food Stuffs: 2008-2013 |

Source: Euromonitor International from UN Food and Agriculture Organisation, FAOSTAT

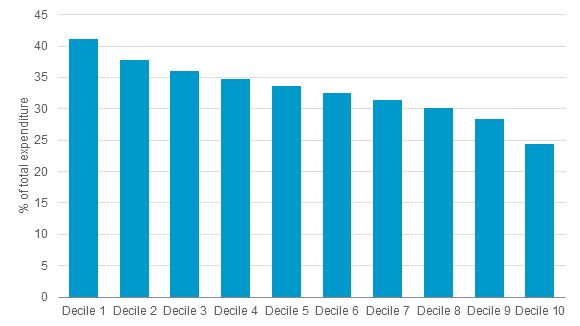

Consumer spending in Russia on food and non-alcoholic beverages is high – accounting for 30.5% of all consumer spending in the country in 2013. This rises to 41.0% for the very poor – decile 1 households. Spending on meat alone totalled US$92,280 million in 2013. Food price rises will therefore have a significant impact on the average Russian household, affecting the poor the most.

|

| Proportion of Spending by Russian Households on Food and Non-Alcoholic Beverages by Income Decile: 2013 |

Source: Euromonitor International from national statistics/Eurostat/UN/OECD

Note: Deciles are calculated by ranking all of the households in a country by disposable income level, from the lowest-earning to the highest earning. The ranking is then split into 10 equal sized groups of households. Decile 1 refers to the lowest earning 10%, through to Decile 10, which refers to the highest earning 10% of households.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!