Analytics, Banks, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Thursday, 18.04.2024, 21:30

Borrowing has become a little more expensive this year in Estonia

Print version

Print version |

|---|

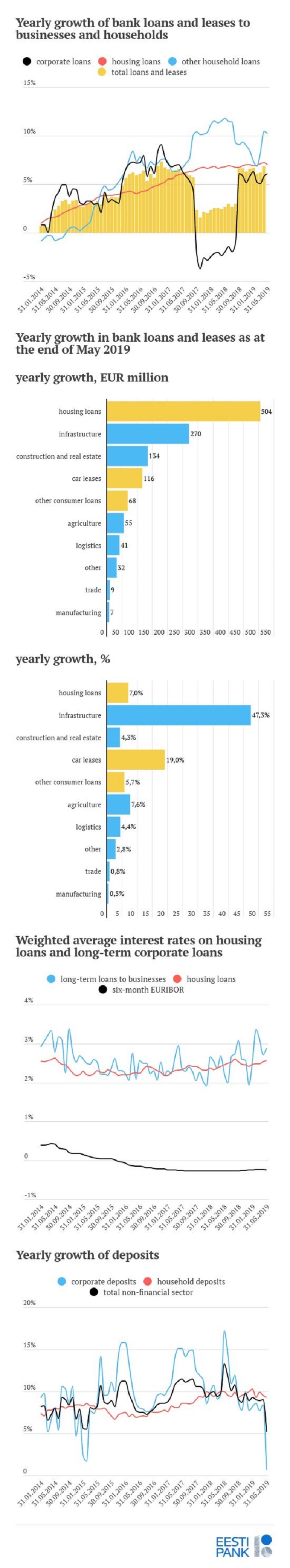

The stock of bank loans and leases issued to companies has grown a little more strongly in recent months, and this boosted annual growth to 6.1% in May. Growth in the loan portfolio was driven in the first half of the year by individual large transactions in the energy sector, but in the past month it was mainly companies in agriculture and real estate that increased their borrowing. In contrast, weak investment by industrial companies has meant that the stock of loans and leases to them is a little smaller than it was at the end of last year.

The stock of housing loans was 7% larger in May than a year earlier, which was a little less than the growth rate in April. About the same number of new housing loan contracts were signed this spring as in the previous spring, and so the rise in the amount borrowed has come primarily because the average loan has increased in size. Car leases showed notably faster growth than housing loans, posting yearly growth of 19% in May. Other consumer loans grew by a slower 5.7%. The rate of growth for car leases and other consumer loans was also increased in the past couple of months partly by the addition of one bank and one leasing company to the list of those with a duty to report. Although slower growth in the economy means the growth in lending to households should also slow, demand for loans will probably be maintained in future by the strong labour market, rapid wage growth and low interest rates.

Household deposits were up more than 9% on a year earlier as growth remained fast. Corporate deposits also increased in May but the yearly rate of growth fell to 0.8%. The rate of growth of corporate deposits slowed notably because individual very large deposits a year earlier had raised the reference base.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!