Analytics, Direct Speech, Industry, Investments, Latvia, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Thursday, 18.04.2024, 11:20

Latvia: Investment strengthens the manufacturing sector

Print version

Print versionThis year, more dynamic manufacturing growth was prevented by insufficient capacity on the supply-side (i.e. high capacity utilisation of the existing machinery and labour shortage), observed earlier and still relevant in some sectors and limiting many producers' capacity to execute larger orders. Hence, the declining activity of customers did not have too pronounced an effect on the production output. Moreover, new investment has enabled producers, whose products have remained in high demand, to expand their production.

However, the current situation will most likely not last for long and unfavourable developments in the external economic environment will also have repercussions for the manufacturing sector performance. In addition, weaker performance is expected in the wood processing sector. The prices of wood have recorded a sharp fall over the past few months. In the first quarter, the output of the wood processing sector was relatively high and provided a significant contribution to manufacturing growth. However, it can be relatively reliably predicted that the sector's performance will weaken in the second half of the year, with only selected sectors, e.g. the secondary processing sector, maintaining good performance, as long as the final product prices remain stable vis-à-vis the falling commodity prices. Last year, the wood processing sector saw significant investment in machinery, including various automation processes, which could support the sector's growth and improve its competitiveness.

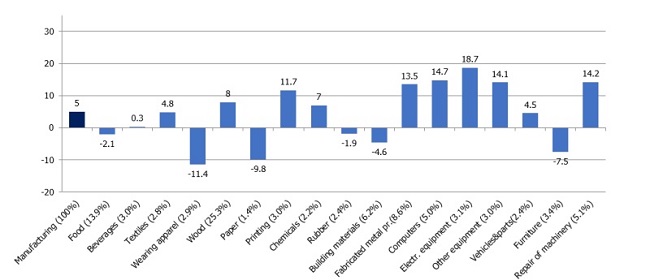

High technology sectors, e.g. the manufacture of electronic and electrical equipment and other machinery and equipment, remained significant contributors to manufacturing growth in the first quarter. The above sectors are characterised by relatively high performance, and their rapid growth over the past years has been an important driver of the entire manufacturing sector. At the same time, these sectors are highly export-oriented and thus subject to the impact of the external demand. Therefore, their growth is likely to slow down.

Since 2017, investment has seen more rapid recovery in Latvia, with investment in industrial machinery and equipment posting a particularly dynamic expansion in 2018. While the weakening of the external demand raises concern about the investors' interest in making future investments, it should be noted that many major investment projects were launched last year and will continue for several years. Besides, there are talks of launching new projects as well. For instance, Gallusman Ltd. plans to construct a new site in Madliena for the production of eggs and egg products (over 85 mln euro investment); the construction of a new industrial park, which is to become one of the largest logistics centres in the vicinity of Riga, has been commenced in the Stopiņi municipality (45 mln euro investment); JSC Dobeles dzirnavnieks plans to invest 18 million euro in the development of the largest full organic grain processing infrastructure in the Baltic States, etc.

The long-conceived and thought-through investment projects, both the completed ones and those still at the planning stage, are primarily funded by using businesses' own financing as well as the financing of the European Union funds, with lending growing only slowly and the debt burden gradually declining. This suggests that investors have carefully considered the sustainability of their projects, also under the circumstances of slower economic growth; moreover, improved productivity will strengthen their competitiveness which will be of key importance under tightening competition.

Volume indices of manufacturing subsectors in the first quarter of 2019 (y-o-y; %; output weights; %)

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!