Analytics, Banks, Direct Speech, Economics, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 14:14

Monetary growth in Latvia remains moderately positive

Print version

Print versionThis year, however, was different: moderate growth was reported in both lending (to non-financial corporations and households) and deposits (total domestic deposits and corporate deposits). Only household deposits contracted slightly in January, with households spending their savings from December.

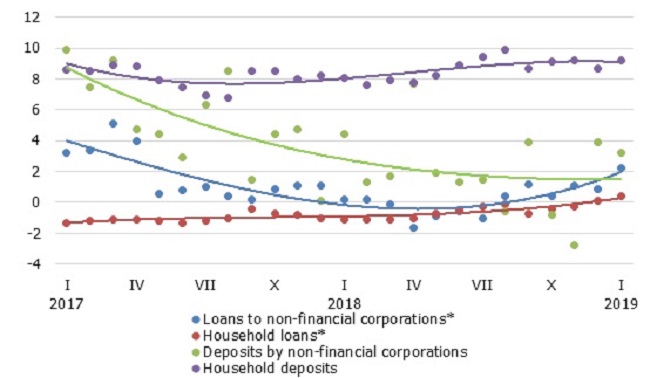

Domestic loan portfolio grew by 0.5% overall in January, including 0.5% increases in loans to non-financial corporations and in residential loans as well as a 0.6% rise in consumer credit. The annual rate of change in domestic loans improved to –3.7%, with the respective rates of loans to non-financial corporations and household loans rising to –3.9% and –5.2%. At the same time, the effect from the banking sector restructuring excluded, the rate of change in all segments remained positive at 1.8%, 2.2% and 0.4% respectively.

In January, the annual growth of domestic bank deposits amounted to 6.0%, with household deposits and deposits by non-financial corporations increasing by 9.2% and 3.2% respectively over the last 12 months. Latvia's contribution to the monetary aggregate M3 of the euro area contracted in the first month of the year, with both overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits with an agreed maturity of up to two years shrinking. The annual growth rates stood at 12.8%, 13.7% and 22.0% respectively. At the same time, deposits redeemable at notice expanded in January.

The loan portfolio and deposits can be expected to increase gradually throughout 2019, although the rate of growth will be modest. Businesses will still be able to use their bank savings to finance investment rather than merely increase their liabilities to banks in the circumstances of weakening external environment. Consequently, corporate deposits are likely to grow at a slow rate and the demand for loans will be moderate. Moreover, further restructuring of the banking sector that has just been announced, i.e. Danske Bank decision to discontinue its business in the Baltic States, including in Latvia, can also be expected to have a dampening effect on the stock and growth rates of the monetary aggregates in 2019.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!