Analytics, Banks, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 15:07

Corporate equity is no longer growing at the same rate

Print version

Print version |

|---|

The growth in equity has probably been restrained by the slower growth in profits, larger dividend payouts and the lack of new foreign direct investment. Given that corporate equity had mostly grown faster than debt capital over the previous eight years or so, it is no problem, at least in the short term, if debt grows a little faster and financial leverage increases. Further changes in equity are most likely to be driven by the growth in corporate profits, which in turn will depend on the development of the economy and the ability of companies to keep their spending under control.

Corporate debt continues to grow markedly more slowly than the economy as a whole, and it posted a rate of 5.6% in the third quarter. The growth was a little less than in the second quarter, which was mainly because of bonds issued abroad reaching maturity, and a slight drop in borrowing from banks and holding companies operating in Estonia. The Eesti Pank December forecast expects that corporate debt will grow by around 6% a year on average in the coming years.

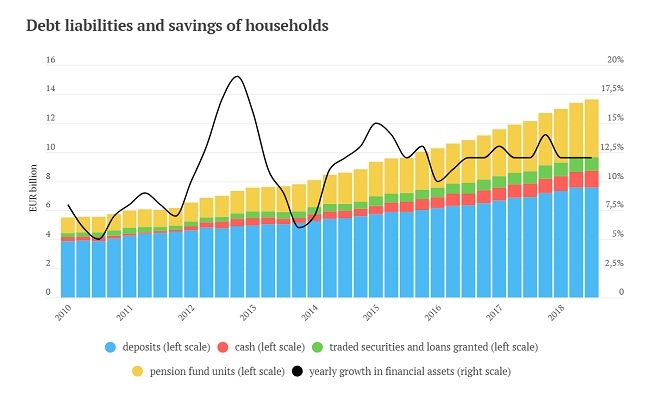

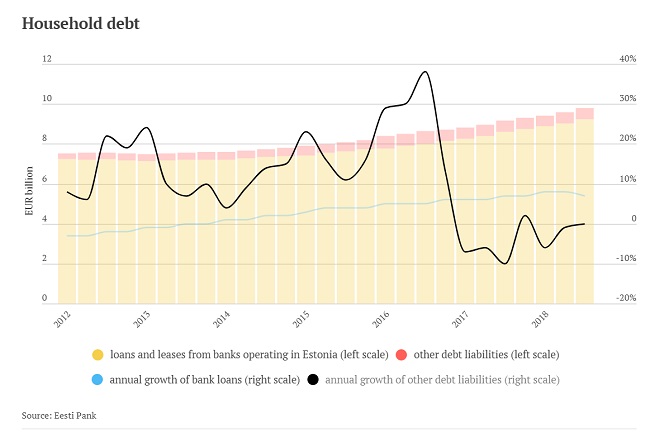

The financial position of households improved in the third quarter of 2018, as their savings grew faster than their debt liabilities.Household deposits increased by 10% over the year in the third quarter, and other household financial assets like cash, securities and investment fund units grew even faster. The assets built up in pension funds also grew. The fall in securities markets in Estonia and in rest of the world came to a large extent at the very end of the year, and so it did not have any impact in the third quarter. Household debt liabilities grew by a little under 7%, which is about the same rate as incomes. Loans continued to be taken most from banks, while the loans growth at other lenders was slower.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!