Banks, Direct Speech, Economics, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Thursday, 18.04.2024, 14:04

Lending development from a sectoral perspective

Print version

Print version |

|---|

However, to ensure sustainable economic growth, wider access to loans for investment purposes is required. Also in years when the loan portfolio contracted substantially overall, several sectors found themselves in a more favourable situation than the economy as a whole, with loan investment continuing to contribute to economic recovery during the post-crisis period.

The share of loans received by economic sectors in Latvia does not differ significantly from the euro area's common indicators as well as from analogous data in Estonia and Lithuania. This is related to Latvia's presence in the common economic area and its broadly similar economic structure.

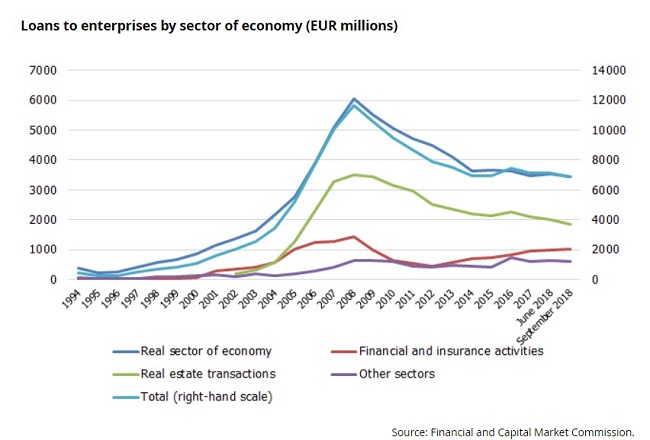

When examining lending dynamics in the longer term (see the Chart), it is evident that the rapid expansion of lending in 2005–2008 was driven by both growth in loans to the real estate sector associated with the real estate bubble and by the increased lending to the real sector of economy. Meanwhile, the last five years have seen the loan portfolio stabilise; it has been continuing on a moderate downward trend primarily in real estate business. This development is positive from the point of view of portfolio diversification.

Loans to enterprises by sector of economy (EUR millions)

A large proportion of loan resources reaches the real economy indirectly, i.e. loans granted for carrying out real estate operations go into construction and related sectors, while loans to financial intermediaries granted through leasing agents allow businesses active in different sectors to purchase equipment and vehicles.

In 2007–2012, the sector's share in the total loan portfolio reached a third of all loans and, despite the slight decrease in the above share, the sector continues to play the dominant role. At the same time, the share of financial intermediation is increasing in the portfolio of granted loans, with the financial sector being the second largest beneficiary of loans over the past two years.

Among the sectors of the real economy, the trade and manufacturing sectors stand out as the major beneficiaries of loans. Loan investment in the above two sectors and in construction surged until 2008, but decreased dramatically during the crisis. With loan investment in the construction sector continuing on a downward path and the loan portfolio of manufacturing companies slightly contracting, credit flows have been shifting towards the trade sector since 2015. Manufacturing is a sector which leaves more active inflows of loan resources to be desired as the fluctuating external demand and inadequate financial indicators have so far prevented banks from accelerated investment in the sector. On the other hand, trade is a sector whose growth has been enhanced both through the creation and expansion of the large shopping centres and development of traders' networks in conditions of robust domestic demand

Meanwhile, loan investment in the sectors such as transport, energy and agriculture has already been growing moderately and quite steadily for more than 20 years; the above sectors were marginally affected by the crisis. Banks have perceived the large businesses prevailing in the areas of infrastructure and energy supply as stable and able to borrow also during the crisis. Moreover, the availability of European Union funds has contributed to the desire of banks to lend both to the above two sectors and the agricultural sector and has supported the ability of these sectors to borrow.

The loan portfolio, diversified to meet the needs of the economy, ensures more robust economic growth and also mitigation of risks to financial stability.

However, lenders, entrepreneurs and policy makers should constantly and jointly assess the situation to achieve the set growth and risk mitigation objectives.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!