Banks, Direct Speech, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Wednesday, 24.04.2024, 12:21

Ice between households and banks gradually melting

Print version

Print version |

|---|

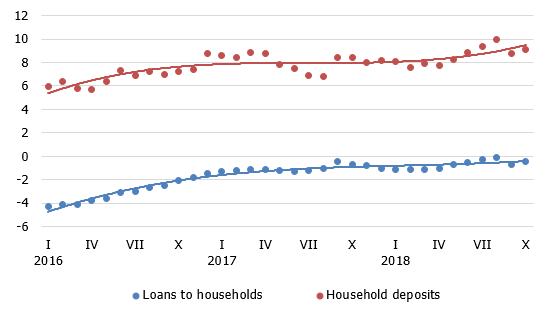

Monetary developments were primarily driven by business with households in October. Overall, household loans increased at a rate that had not been seen since May, whereas the monthly growth of the residential loan portfolio was the highest since 2008. At the same time, consumer credit also expanded. The growth rate of household deposits exceeded that of corporate deposits with banks.

Despite the household loan portfolio increasing by 0.3% in October, the overall domestic loan portfolio somewhat decreased, with the annual rate of decline standing at –4.6% (the effects of the banking sector restructuring excluded, the annual growth rate of the domestic loan portfolio amounted to 1.0%). The decline was a result of the persistently weak corporate lending: the loan portfolio of non-financial corporations contracted by 0.4% in October, with the annual rate of decrease standing at –5.5% (the previously-mentioned effects excluded, the annual growth of the loan portfolio totalled 0.4%). At the same time, residential loans and consumer credit grew by 0.3% and 1.0% respectively, with the adjusted annual rate of change amounting to 0.3% and 1.8% respectively.

Domestic bank deposits increased by 1.0% in October, with household deposits and corporate deposits growing by 1.1% and 0.9% respectively. Latvia's contribution to the monetary aggregate M3 of the euro area increased by 1.0% in October, with overnight deposits of euro area residents with Latvia's monetary financial institutions and deposits redeemable at notice growing by 1.4% and 0.8% respectively and deposits with an agreed maturity of up to two years contracting by 2.6%.

Annual changes in household loans* and household deposits (%)

* For the sake of comparability, the one-off effects relating with the restructuring of Latvia's banking sector have been excluded.

Incoming data of the most recent months show that the economic growth, shrinking unemployment and overall labour market situation encourage households to borrow more as well as enable them to save more on their bank accounts. Although the external demand developments suggest that next year we can expect a slow-down in the domestic environment as well, no reversal is anticipated for household lending and household savings. Nevertheless, businesses could respond to the upcoming growth deceleration with a more cautious borrowing policy which is already partly evident as the lending recovery is slower than expected.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!