Analytics, Banks, Direct Speech, Estonia, Financial Services

International Internet Magazine. Baltic States news & analytics

Tuesday, 23.04.2024, 22:20

Deposits continue to grow faster than loans

Print version

Print version |

|---|

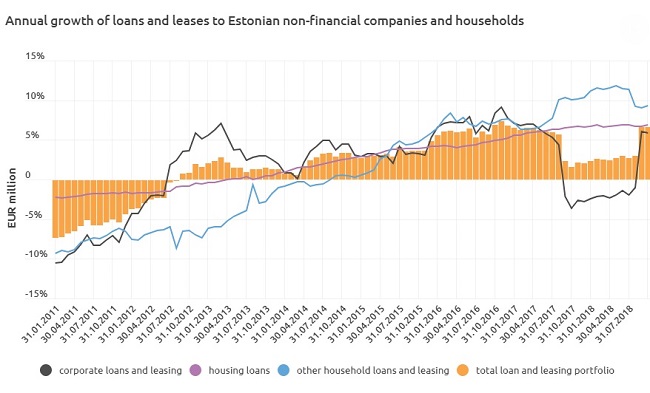

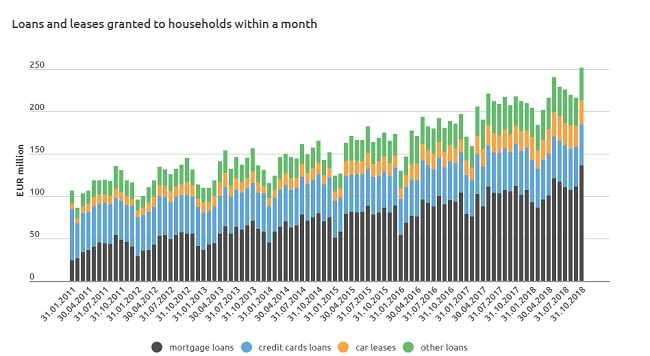

Some 136 million euros of new housing loans were taken out in October, which was over 20% more than a year earlier. This was because more new loan contracts were signed, and also because the average value of loans increased. This reflected a burst of activity in the housing market and the rise in real estate prices. As less was taken out in housing loans in earlier months, some loan transactions may have been moved across into October. This means that although a lot of new housing loans were issued in October, the rate of yearly growth in the stock of housing loans was similar to that in the other months of the year at close to 7%.

Households remained as keen as previously to sign new car lease contracts. The growth in the value of car leases, which has remained in double digits for more than three years, showed no signs of slowing in October. The stock of car leases was 21% larger than a year ago, and both the number of transactions and also the average value of the leases have increased. Other consumption loans were up more slowly, by only 4% over the year.

Companies borrowed more actively in October than earlier, especially in short-term loans, as more than one fifth more in volume was added over the year. Long-term loans were taken more cautiously, though still 4% more in volume than a year earlier. Overall the stock of corporate loans and leases was up 6% over the year in October, and the loan portfolio increased in volume fairly evenly across all the major sectors of activity. Faster growth than for the portfolio as a whole was found at companies in industry and administration and support activities.

The average interest margins on new loans have risen gradually throughout 2018, but they did not move any further upwards in October. The average interest margin on housing loans remains at 2.5% and the average interest rate on new long-term corporate loans was 2.6%, both of which are a little higher than a year earlier.

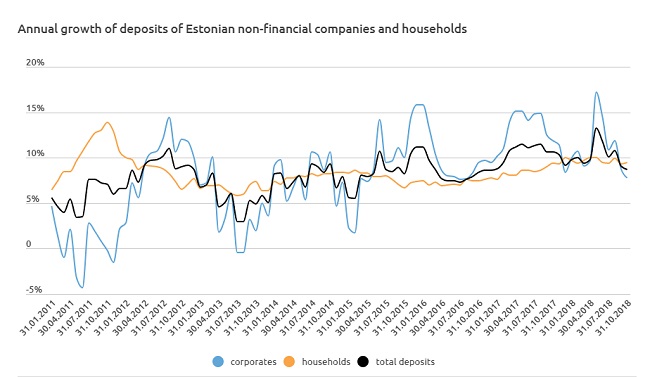

The deposits of Estonian companies and households again grew faster than the stock of loans and leases. Although the rate of growth was a little bit higher a year earlier, it was still at 9% in October. The value of non-resident deposits fell by a quarter over the year, to account for 7.4% of the stock of corporate and household deposits at the end of October.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!