Analytics, Banks, Direct Speech, Economics, Industry, Latvia

International Internet Magazine. Baltic States news & analytics

Friday, 19.04.2024, 21:49

Manufacturing: neither fish nor fowl, and lack of cooks and pots and pans

Print version

Print version |

|---|

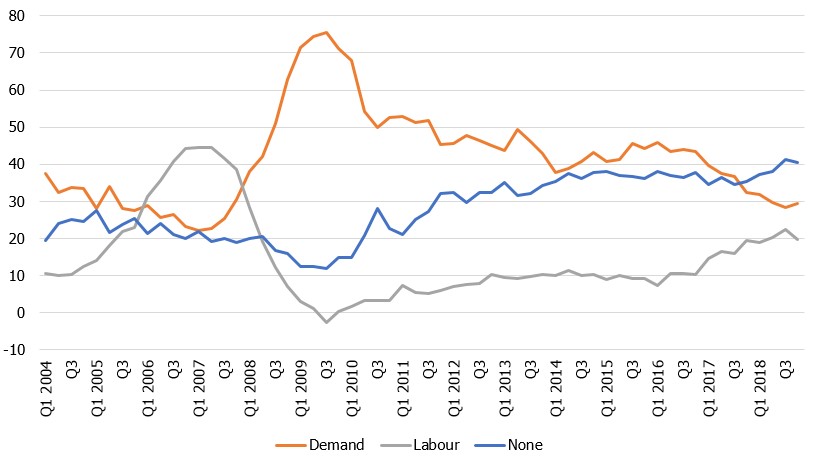

The major obstacle to faster growth is the insufficient capacity on the supply side: as a result of the labour shortage and high production capacity utilisation, the supply fails to satisfy the high demand observed in many sectors. Several professional associations, e.g. of mechanical engineering, have pointed to the high demand; however, the macroeconomic indicators show growth deceleration in Latvia's trade partners signalling a potential moderation of the external demand.

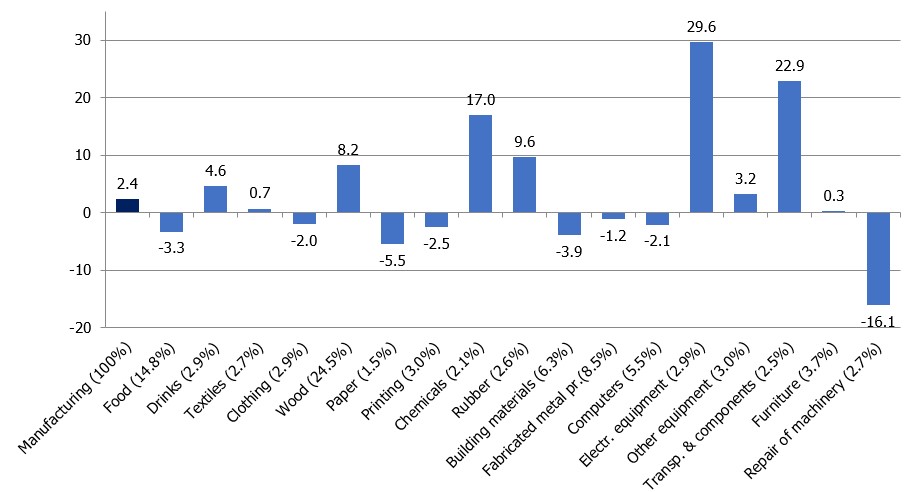

After a poorer performance in July, manufacturing showed some improvement in August, whereas September was a disappointment again. The third quarter results are not bad overall, but there's no place for ovations either, with 0.9% and 2.4% growth quarter-on-quarter and year-on-year respectively. This year also saw different troublesome developments: fire at the warehouse of Mikrotīkls, a major software and hardware company, uncertainty concerning the future management of the huge pharmacy company Olainfarm etc. This year the biggest disappointment by sub-sector was the food industry, which is important due to its notable share, i.e. approximately 15% of manufacturing output, and the dairy processing sector in particular, with its pronounced downward dynamics. This sub-sector has two "stories of failure": Baltic Dairy Board in Bauska and Latvian Dairy in Sērene, who both stopped to pay farmers for the supplied milk and in short time accrued debts to farmers amounting to several millions of euro. For other dairy processors, the year has been quite successful, with the year-end also expected to be productive. Other sub-sectors have also achieved quite good results, particularly manufacture of motor vehicles and their components, electrical equipment, chemicals and chemical products, wood industry etc.; however, it is quite difficult to maintain high growth rates after the accelerated growth observed last year, and raising output also has its limits.

Over the year, the insufficient capacity of the supply side grew more acute and along the lack of labour increased the pressure on wages and salaries; however, the fourth quarter saw a change in the measures of capacity utilisation and factors limiting growth (see Chart 2). Nevertheless, these are most likely only short-term fluctuations and the trends will resume their path. Most of the producers visited in the context of the competition "Export and Innovation Award" point to an increasing issue of labour availability. According to statistical data, investment in machinery equipment has been modest, therefore we can't expect the issue of the high capacity utilisation to be solved.

Recently several new investment projects have been announced, but these have been planned in other sectors, mostly in energy and trade. Of investment in manufacturing, the highest expectations are associated with the companies already referred to in the commentary of the previous quarter: fibreboard producer Kronospan Riga, food producer Orkla, and other smaller projects. According to industry associations, there are many businesses who do invest, but investment is basically focused on improving automation and efficiency in order to solve the issue of labour shortages, with fewer plans for expanding production.

Although manufacturing provides positive surprises from time to time, there is no reason to expect faster growth without more profound investment. It can't be denied that positive surprises sometimes occur as a result of ideas of new and innovative products materialising in skyrocketing explosions of financial indicators; nevertheless, to have such cases contribute to the total performance of industry, time, labour and capital investment is prerequisite. Still, to get some inspiration, it is worth having a look at the reports of visits to the companies participating in the competition "Export and Innovation Award" at the news portal Delfi Business section.

Chart 1. Volume indices of manufacturing sub-sectors in Q3 2018 (%; year-on-year; output weights in %)

Chart 2. Factors limiting production; %

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!