Analytics, Direct Speech, Estonia, Real Estate

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 15:00

The housing loan market in Estonia is moderating its speed

Print version

Print version |

|---|

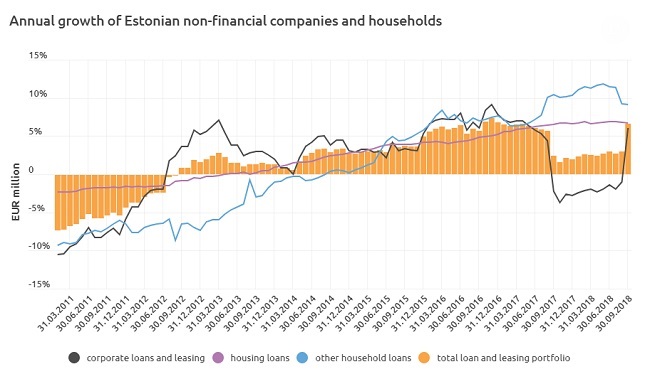

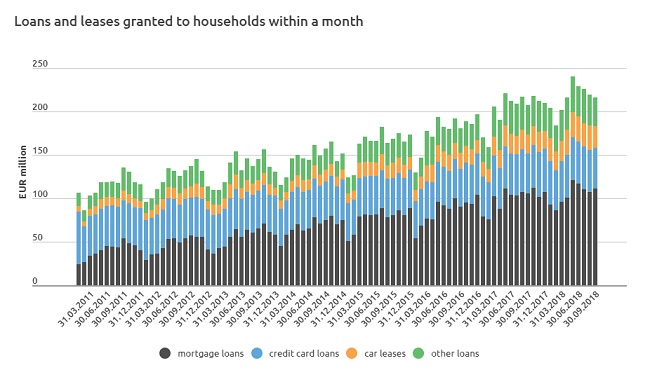

Fewer new housing loans have been taken out in recent months than previously, and the growth in the stock of housing loans did not accelerate further in August or September. The stock of loans in September was 6.7% larger than in September 2017. Similarly, fewer transactions were made in the apartment market in the third quarter than a year earlier and the growth in average prices slowed. The coming months will show whether this calming occurred because fewer transactions with new apartments were made in the third quarter, or whether demand for housing and housing loans has started to decrease.

New car lease contracts were signed by private clients at the same rapid rate as before though. The stock of car leases was more than a fifth larger than a year earlier. Car leases continue to make up a relatively small part of the total stock of bank loans and leases to households though, at 7%. The growth is slower in other consumer loans than in housing loans and car leases, and the stock of such loans was 4% larger in September than a year earlier.

The yearly growth in loans and leases issued to companies was 6.1% in September. The rate of growth has been more or less the same throughout 2018, if the one-off large reduction in the loan stock in autumn 2017 is left aside[1]. The fastest growth in borrowing has been from companies in administration and support activities and from industrial companies.

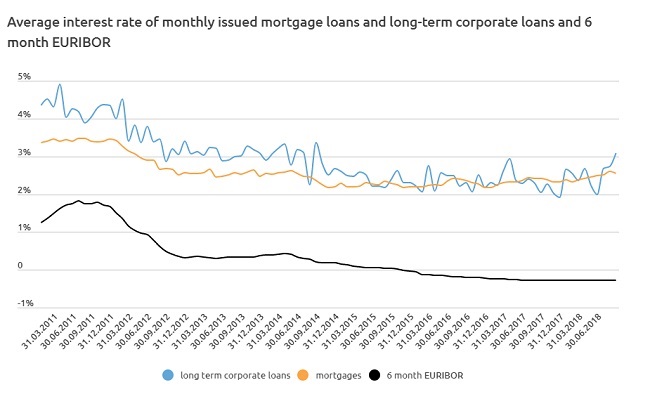

The average interest margins on new loans have risen a little in 2018. The average interest margin on housing loans did not rise any further in September, but it still remained higher than a year earlier. For new housing loans the average interest margin was 2.5% in September. The average interest margin on corporate loans can be very variable because of the diversity of company loan projects, but in the first three quarters on average it is been higher than in the same quarters of last year.

The bank deposits of companies and individuals were down a little in September, but still 9% up on a year earlier. Deposits have grown a little faster than loans and leases and the financial buffers of companies and individuals have increased. The deposits of non-residents were more than a quarter smaller in September than a year earlier. At the end of September around 7% of the stock of corporate and private deposits were non-resident.

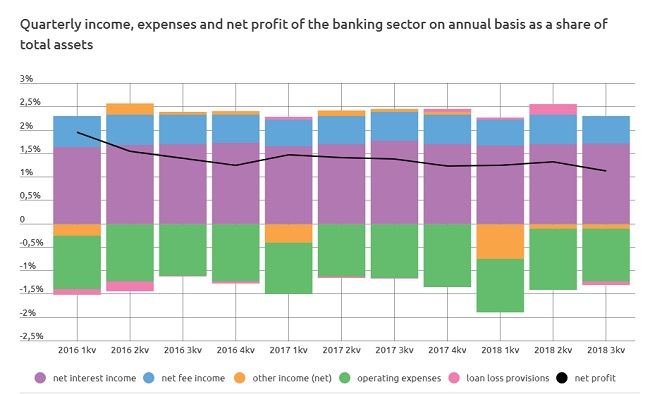

The banks earned 70.8 million euros in net profit in the third quarter, which is 16% less than in the same quarter of last year. Net profit was reduced by write-downs to cover loan losses and by higher income tax expenses than a year earlier. More or less the same amount was earned in net interest income as a year previously, and a little less in net service fee income. The return on the assets of the banking sector over the year was down from 1.4% a year earlier to 1.1% in the third quarter of 2018, which is still above the average for the European Union countries.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!