Analytics, Banks, Direct Speech, Economics, Financial Services, Latvia

International Internet Magazine. Baltic States news & analytics

Thursday, 18.04.2024, 09:24

Stability with a positive note

Print version

Print version |

|---|

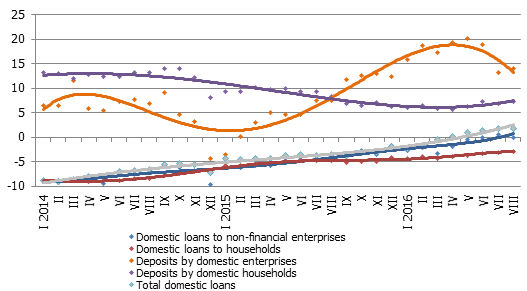

The balance of the domestic loans of banks in August increased by 0.2%, with the loans granted to nonfinancial enterprises increasing by 0.3%, loans to financial institutions by 1.3% and consumer loans to households by 1.1%. The housing loan balance continued to contract gradually and slowly (by 0.2%). The rate of 12-month increase in total domestic loans in August was at 1.7%, including 0.0% in loans to nonfinancial companies and 58.7% to nonbank financial institutions. The 12-month rate of decrease in loans granted to households dropped to 2.9%.

Domestic deposits attracted by banks increased in August by 0.9%, with their 12-month rate of growth reaching 10.3%. Deposits by enterprises increased by 2.3% (annual growth rate of 14.0%), whereas deposits by households dropped by 0.3% (annual growth rate of 7.2%).

With deposits increasing, so did Latvia's contribution to the euro area total money supply indicator M3. Overnight deposits of the euro area residents with Latvian credit institutions in August increase by 1.0% and deposits redeemable at notice by 0.8%, with only deposits with the set maturity of up to two years dropping minimally. Altogether, Latvia's contribution to the euro area M3 increased by 0.9%, which amounted to 10.3% growth year-on-year.

Y-y changes in some money indicators (%)

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!