Direct Speech, Energy, EU – Baltic States, Gas, Latvia

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 12:52

Nord Stream facing future. First article.

Print version

Print version |

|---|

BC: We frequently happen to hear that the Nord Stream 1 pipeline is not operating at full capacity. Various figures are mentioned — 50%, 70%. Is this the case?

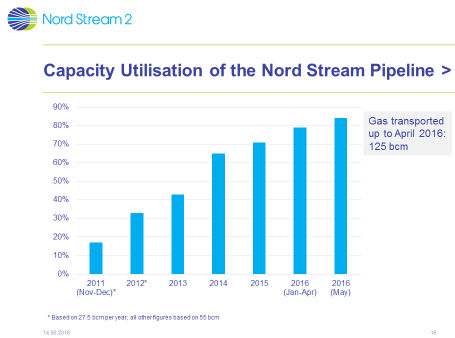

R. Baumanis: These figures do not reflect the true situation. Currently the pipeline is operating at 82% of its capacity, its utilization rate has been constantly growing every year. (See Table 1). However, we should not focus on the utilization rate of the pipeline alone. Such an approach is overly simplistic and does not reflect the commercial realities of the project. By the way, it is hardly likely that any infrastructure project is operating at 100% of its capacity; take, for instance, the operation of a road or of port capacities. The Nord Stream 1 project received 70% of its funding on financial markets and only 30% was provided by the shareholders – Gazprom (Russia), E.ON Ruhrgas (Germany), Wintershall (Germany), Nederlandse Gasunie (the Netherlands), Gas de France Suez (France). The 70% commercial funding is the most objective criterion of the commercial success of the Nord Stream 1 project, as the project not only underwent a very thorough evaluation by the financial lenders, but also had to implement a set of conditions to correspond to very strict criteria for receiving this funding. Unfortunately, people frequently forget about the crucial role the financial market plays in funding large, socially significant projects.

While

talking about Nord Stream 1, R.

Baumanis emphasised that the Nord Stream first pipeline project was a resounding

success in terms of meeting the budget, deadlines and having a perfect safety

record. Nord Stream 1 received

multiple awards in various categories, including about the logistical aspect of

the construction. It was so unique that the German Logistics Association

established a special award for a foreign company Nord Stream AG (Switzerland).

R. Baumanis also reiterated that all of the ecological concerns following the implementation of Nord Stream 1 project proved to be ungrounded. The pipeline has become part of the marine environment.

BC: If everything is so wonderful, why was the second project Nord Stream 2 needed?

R. Baumanis: This need is comes from the long term gas demand forecast on the European market. One of the peculiarities of the energy business lies in the fact that it requires long-term future forecasts, of at least fifteen or twenty years. The certified operational life span of Nord Stream 1 is 50 years. It only seems to be a lot at a first glance, the time passes quickly. Look, for example at the Ukrainian gas transmission system, it was built in the sixties of the previous century. We will look into it in some more detail in one of our future interviews of these series. I will only just mention now that planning decades ahead is a standard practice in the energy sector.

We will dedicate our next conversation to the examination of factors that made the shareholders to develop the new project Nord Stream 2. This time the list of shareholders of the project include Gazprom, E.ON (Germany), Royal Dutch Shell (Norway), BASF/Wintershall (Germany), OMV AG (Austria) and ENGIE (France).

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!