Analytics, Baltic, Financial Services, Real Estate, Society

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 21:43

Number of residents who make savings increases in Baltics in 2014

Print version

Print version

The number of people who have no financial reserves has reduced in all Baltic States as compared to 2011.

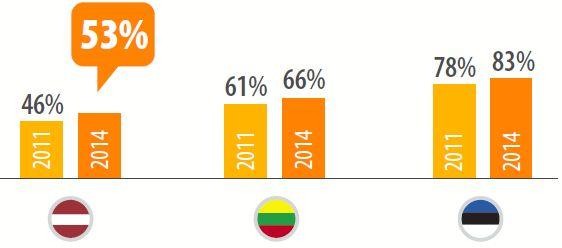

In 2011, 78% of residents in Estonia had personal savings, 61% – in Lithuania, and 46% – in Latvia. Thus, Latvia registered the fastest increase in the number of people who make savings during the past three years.

A large number of people in the Baltic States agree that making financial savings is important; this belief has not changed during the past three years. The study reveals that people most often choose to save their money in banks; the sums are usually lower than EUR 1,000.

|

| Baltic residents who make savings |

Swedbank representative Ieva Use-Cimmermane indicated that specialists suggest to make savings in the amount of three to six monthly pays. "The average monthly net pay in the first half of this year was EUR 790 in Estonia, EUR 551 in Latvia, EUR 527 in Lithuania. Thus, it is obvious that in case of losing a job, a person would be able to support their family for a couple of months only, which is insufficient in order to feel financially secure," Use-Cimmermane said.

People usually choose to save money for two reasons – to save for a "rainy day" (67% of Latvians, 62% of Lithuanians and Estonians) and to cover some larger purchase in the future, for example, traveling costs (35 of Lithuanians, 32% of Latvians and Estonians).

Swedbank survey indicated that 15% of Estonian population does not have any savings at all but the amount has decreased in the past three years, LETA/Delfi reports.

"According to this year's study, 15% of people in Estonia have no savings at all. The people who have no savings has the highest share of low-income people and Estonian residents of other nationalities, as well as students and young people aged 18-25 years," said Swedbank Institute for Private Finances head Lee Maripuu.

The majority of Estonian people (83%) have savings and the majority agree that saving is important.

Mostly Estonians are able to save up to 10% of their income. Comparing the savings habits of men and women, there are more people among women who are able to save up to 5% of salary (43% of women and 34% men), while more people among men who are able to save 5-10% of their income or more

.

Maripuu said that probably one of the important factors here is the average pay gap between men and women, which is to the disadvantage of women.

Only 6% of savers can save over 15% of the income and they usually belong to the larger wage earners group.

Among the lowest-income people, the biggest part – 48% – can save up to 5% of their income.

The preferred place to deposit savings is a bank account, where 76% of the respondents keep their savings. 23% keep it at home in cash.

The savings accumulated on bank account are usually between 300 and 1,000 euros, cash savings at home amount to 300 euros.

62% of people save for "a rainy day", 32% save for bigger purchases like travel, car, home appliances, and 22% for children's needs, 20% to renovate their home, 18% for pension and 11% to by a home.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!