Analytics, Financial Services, Labour-market, Latvia, Markets and Companies, Wages

International Internet Magazine. Baltic States news & analytics

Friday, 19.04.2024, 06:30

Hourly labour costs in Latvia have grown by 51 cents in Q2

Print version

Print version

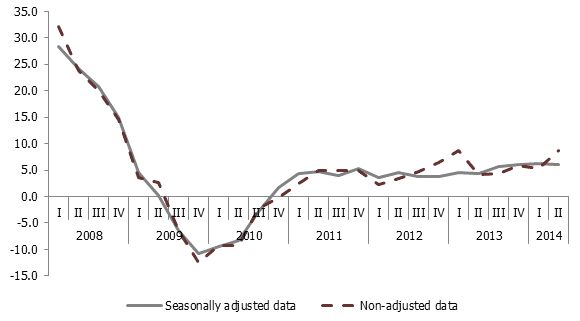

Seasonally adjusted data (differences in number of calendar days and seasonal influence have been averted) show that labour costs have increased by 6.0%.

|

| Changes in hourly labour costs over the corresponding quarter of the previous year, % |

Data source: Central Statistical Bureau of Latvia

Compared to the corresponding period of the previous year the most notable increase in hourly labour costs in the 2nd quarter of 2014 was recorded in real estate activities – of 12.9%, in accommodation and food service activities sector – of 11.6%, in administrative and support service activities – of 11.0%, in construction – of 10.6%, as well as in financial and insurance activities sector – of 10.3%.

Regular wages and salaries in real estate activities grew by 12.2%, while the number of hours worked declined by 2.6%.

In accommodation and food service activities, in administrative and support service activities, as well as in construction rise was recorded both in regular wagesand irregular premiums and bonuses.

In turn, in financial and insurance activities a gradual decline was recorded in the number of employees as well as in hours worked, while regular wages and irregular premiums and bonuses still showed a positive trend.

Changes in hourly labour costs and wages in the 2nd quarter of 2014 by economic activity, non-adjusted data, EUR

|

|

Hourly labour costs |

of which hourly wages and salaries |

||||

|

2nd QTR 2013

|

2nd QTR 2014 |

Changes, % |

2nd QTR 2013 |

2nd QTR 2014 |

changes, % |

|

|

Total (B-S) |

6.06 |

6.58 |

8.6 |

4.85 |

5.30 |

9.4 |

|

Mining and quarrying (B) |

6.69 |

7.19 |

7.6 |

5.35 |

5.78 |

8.0 |

|

Manufacturing (C) |

5.58 |

6.06 |

8.5 |

4.44 |

4.86 |

9.3 |

|

Electricity, gas, steam and air conditioning supply (D) |

9.13 |

10.03 |

9.8 |

7.00 |

7.71 |

10.2 |

|

Water supply; sewerage, waste management and remediation activities (E) |

6.22 |

6.51 |

4.7 |

4.94 |

5.18 |

5.0 |

|

Construction (F) |

5.44 |

6.02 |

10.6 |

4.38 |

4.89 |

11.6 |

|

Wholesale and retail trade; repair of motor vehicles and motorcycles (G) |

5.19 |

5.55 |

6.9 |

4.15 |

4.47 |

7.5 |

|

Transportation and storage (H) |

6.77 |

7.24 |

6.9 |

5.38 |

5.80 |

7.9 |

|

Accommodation and food service activities (I) |

3.91 |

4.37 |

11.6 |

3.14 |

3.53 |

12.4 |

|

Information and communication (J) |

9.36 |

10.12 |

8.1 |

7.51 |

8.19 |

9.1 |

|

Financial and insurance activities (K) |

13.59 |

14.99 |

10.3 |

10.73 |

12.15 |

13.3 |

|

Real estate activities (L) |

5.02 |

5.67 |

12.9 |

4.03 |

4.60 |

14.4 |

|

Professional, scientific and technical activities (M) |

6.79 |

7.33 |

8.0 |

5.62 |

6.13 |

9.0 |

|

Administrative and support service activities (N) |

5.14 |

5.70 |

11.0 |

4.17 |

4.66 |

11.7 |

|

Public administration and defence, compulsory social security (O) |

7.80 |

8.56 |

9.7 |

6.19 |

6.82 |

10.1 |

|

Education (P) |

5.31 |

5.79 |

9.1 |

4.28 |

4.67 |

9.3 |

|

Health and social work (Q) |

5.46 |

5.96 |

9.0 |

4.38 |

4.80 |

9.7 |

|

Arts, entertainment and recreation (R) |

5.35 |

5.52 |

3.1 |

4.31 |

4.49 |

4.3 |

|

Other service activities (S) |

4.67 |

4.85 |

3.9 |

3.87 |

4.05 |

4.6 |

Both seasonally adjusted and seasonally non-adjusted data are available in the CSB database.

Explanations

Hourly labour costs include gross wages and salaries and other labour costs.

Wages and salaries are regular and irregular direct wages and salaries – basic salary (monthly, wage), payment for time worked or job completed, regular and irregular premiums and bonuses, payments for days not worked (vacation and other days not worked), state mandatory social insurance contributions paid by the employees and personal tax. In line with the European Union (EU) regulatory enactments, when compiling data on labour costs, wages and salaries also include remuneration in kind (goods and services provided by the employer to employees free of charge or at a lower price, living quarters, mobile telephone, transport compensation etc.). Other labour costs include statutory social security contributions payable by employer, employers’ contractual and voluntary social security contributions (additional pension insurance contributions, health and life insurance contributions etc.), support payments from employer, awards, gifts, payments for sick list A, severance pay, entrepreneurship state risk duty.

Hourly labour costs are calculated dividing the sum of labour costs by the number of hours worked.

According to the EU regulatory enactments, hourly labour costs and changes thereof in this publication have been calculated for sectors B-S of the Statistical Classification of the Economic Activities (NACE) Rev. 2.

Indicator changes have been calculated from not rounded values.

Data were recalculated into Euro in line with the fixed exchange rate 1 EUR = 0.702804 LVL.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!