Analytics, Inflation, Lithuania, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 22:23

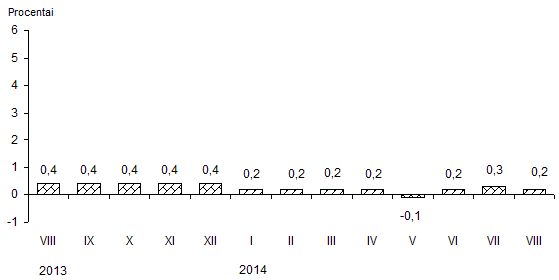

In August 2014, annual inflation stood at 0.2% in Lithuania

Print version

Print version

It was mainly influenced by a decrease in prices for vegetables and an increase in prices for coffee tea and cocoa, gas, fruit, spirits, tobacco products and services of restaurants, cafes and the like (see Table 2).

Over the said period, prices for consumer goods dropped by 0.2, for consumer services – grew by 0.3%. An upward trend in service prices remains.

Prices for consumer goods and services regulated by State and municipal authorities slightly increased (+0.04), while market prices decreased by 0.1%. The influence of the change in prices regulated by State and municipal authorities was positive and stood at plus 0.01 percentage points, while the influence of market prices was negative and stood at minus 0.09 percentage points.

In August 2014, against July, out of food products and non-alcoholic beverages, the largest decrease in prices – 20.1% – was observed for vegetables. Bread and cereals went down in price by 0.5, milk and milk products, cheeses – 0.4%. The largest price growth was observed for coffee – 9.6, fruit and vegetable juices – 2.3, fruit – 2.2, and eggs – 0.9%. Out of fruit, the largest price rise was observed for lemons – 21.5, oranges – 8%; prices for peaches decreased by 21, grapes – 10.2%.

In the group of miscellaneous goods and services, other non-electric appliances, articles and products for personal carewent down in price by 1.5%, while the services of hairdressers and personal grooming establishments went up in price by 0.5%.

In the group of alcoholic beverages and tobacco products, the largest price rise – 1.1% – was observed for cigarettes, 1% – spirits, 0.5% – beer.

As for housing, water, electricity, gas and other fuels goods and services, the largest increase in prices was observed for liquefied gas for cooking – 6.8, housing rent – 2.4, housing maintenance and repair products and materials – 1.1, housing maintenance and repair services – 0.7%. Solid fuel went down in price by 0.9%.

In August 2014, annual (August 2014, against August 2013) inflation stood at 0.2% and was by 0.2 percentage points lower than in August 2013 (in August 2013, against August 2012, it stood at 0.4%).

|

| Consumer price indices during the year, compared to the corresponding month of the previous year |

Annual inflation was mainly influenced by a 15.3% increase in prices for solid fuel, 4.9% – each milk, cheese and eggs and tobacco products, 5.6% – fruit, 3.9% – services of restaurants, cafes and the like, 14.3% – sewage collection services, 13.7% – refuse collection services, 4.6% – beer, 2.1% – spirits, 11.5% – cold water, 1.8% – pharmaceuticals, as well as by a 15.7% decrease in prices for heat energy, 3% – fuels and lubricants, 4.7% – telephone and telefax services, 5.4% – electricity, 10.6% – gas.

Over the year, prices for consumer goods decreased by 0.3, for consumer services – grew by 1.8%.

In August 2014, compared to August 2013, prices for consumer goods and services regulated by State and municipal authorities decreased by 3.5%, while market prices increased by 0.8%.

In August 2014, average annual inflation stood at 0.2% and was by 1.7 percentage points lower than in August 2013 (1.9%).

Table 1. Changes in prices for consumer goods and services, August 2014, %

|

COICOP1 divisions of consumer goods and services |

Relative share (weight) of consumption expenditure in total consumption expenditure |

Price growth, drop (–) |

|||

|

August 2014, against |

average annual August

2013–2014 |

||||

|

July 2014

|

2013 |

||||

|

December |

August |

||||

|

Total CPI |

100.0 |

–0.1 |

–0.1 |

0.2 |

0.2 |

|

Food products and non-alcoholic beverages |

25.2 |

–1.1 |

0.3 |

0.9 |

0.9 |

|

Alcoholic beverages and tobacco products |

7.7 |

0.8 |

4.2 |

4.4 |

3.1 |

|

Clothing and footwear |

7.0 |

0.4 |

–8.1 |

–0.3 |

–0.3 |

|

Housing, water, electricity, gas and other fuels |

14.1 |

0.4 |

–1.5 |

–1.4 |

–0.6 |

|

Furnishings, household equipment and routine maintenance of the house |

4.9 |

0.5 |

–0.6 |

–0.3 |

0.2 |

|

Health care |

6.2 |

0.2 |

2.0 |

1.7 |

1.1 |

|

Transport |

14.2 |

0.0 |

0.5 |

–1.7 |

–1.1 |

|

Communications |

3.5 |

0.5 |

–2.3 |

–4.7 |

–7.1 |

|

Recreation and culture |

6.0 |

0.5 |

1.7 |

0.6 |

0.7 |

|

Educations |

1.7 |

0.0 |

–0.1 |

1.2 |

1.1 |

|

Hotels, cafes and restaurants |

4.0 |

0.6 |

2.8 |

3.3 |

2.6 |

|

Miscellaneous goods and services |

5.5 |

–0.6 |

–0.3 |

0.1 |

0.9 |

---------------

1 Classification of

Individual Consumption by Purpose (COICOP)

Table 2. Largest influence on the overall change in consumer prices over the month (August 2014, against July) by COICOP class of consumer goods and services

|

COICOP classes of consumer goods and services |

Relative share (weight) of consumption expenditure in total consumption expenditure, % |

Price growth, drop (–), % |

Influence, percentage points |

|

|

|

|

|

|

Coffee, tea, cocoa |

1.0 |

6.9 |

+0.072 |

|

Gas |

1.4 |

3.4 |

+0.040 |

|

Fruit |

1.5 |

2.2 |

+0.037 |

|

Spirits |

2.6 |

1.0 |

+0.027 |

|

Tobacco products |

2.3 |

1.1 |

+0.025 |

|

Services of restaurants, cafes and the like |

2.4 |

0.9 |

+0.022 |

|

|

|

|

|

|

Vegetables |

1.9 |

–20.1 |

–0.367 |

|

Other non-electric appliances, articles and products for personal care |

2.6 |

–1.5 |

–0.040 |

|

Bread and cereals |

4.3 |

–0.5 |

–0.022 |

|

Solid fuel |

1.9 |

–0.9 |

–0.020 |

|

Passenger transport by air |

0.5 |

–2.0 |

–0.012 |

|

Milk and milk products, cheese, eggs |

4.1 |

–0.3 |

–0.011 |

The overall change in consumer prices is influenced not only by the size of the

price change for a certain product but also by the relative share (weight) of

expenditure on that product in the total consumption expenditure.

Concepts

Inflation is a decrease in the purchasing power of a currency unit, which manifests itself in a long-term increase in the average general price level.

Annual inflation shows the relative change in the average price level between the reporting month and the corresponding month of the previous year.

Average annual inflation shows the relative change in the average price level between the last twelve months and the corresponding previous twelve months.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!