Analytics, Baltic States – CIS, EU – Baltic States, Financial Services, Funds, Pensioners

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 16:10

Latvia reached top in Pension Sustainability Index 2014

Print version

Print version

Among others, the Scandinavian countries, the United States and the Latvian pension systems proved to be more sustainable than that of Estonia as they reached the top ten.

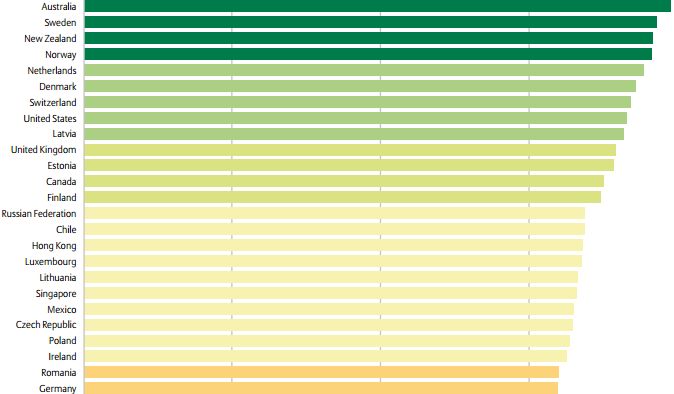

The Allianz International Pension Sustainability Index top three states are Australia, Sweden and New Zealand, followed by Norway, the Netherlands, Denmark, Switzerland, the USA, Latvia and the United Kingdom. Finland is ranked 13th, Russia 14th and Lithuania – 18th.

The Baltic countries' relatively high position in the pension sustainability index is explained with the II and III pillar pension system, which support the state-provided I pillar.

|

| 2014 Pension Sustainability Index |

It also noted the fact that both Latvia and Estonia temporarily increased the second pillar pension contributions, to compensate for the payments stopped during the economic crisis, which allows achieving retirement income beyond the poverty line, while reducing the burden on the state social system.

In the current study, the pension systems of Thailand, Brazil and Japan were found to be the least sustainable in the long run, though for different reasons. Thailand has an extremely low retirement age, only sporadic coverage, and is aging rapidly. It probably postponed to tackle the consequences of its aging problem after disastrous flooding and political turmoil brought other issues to the political agenda. Brazil is also aging quickly, and its pension system has a high replacement rate which, combined with early retirement options, will be unsustainable in the long run.

Japan comes in at the low end of the ranking because of its very old population and very high sovereign debt level. In consideration of these factors, the pension system is still too expensive, making the need for reform an ongoing concern. Greece, which ranked worst in the 2011 PSI, was able to improve due to the drastic reforms stipulated by the International Monetary Fund (IMF) and European Central Bank (ECB) austerity packages. It succeeded in cutting back on pension expenditures with lasting effect. Nevertheless, the high debt level and an old-age dependency ratio (OAD) well above the European average remain a challenge for the Greek system. This is why Greece did not improve more in the ranking.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!