Analytics, Baltic, Covid-19, Financial Services, Real Estate, Wages

International Internet Magazine. Baltic States news & analytics

Saturday, 20.04.2024, 14:21

Housing affordability improves in Riga, deteriorated in Tallinn and Vilnius in Q1

BC, Riga, 10.06.2020. Print version

Print version

Print version

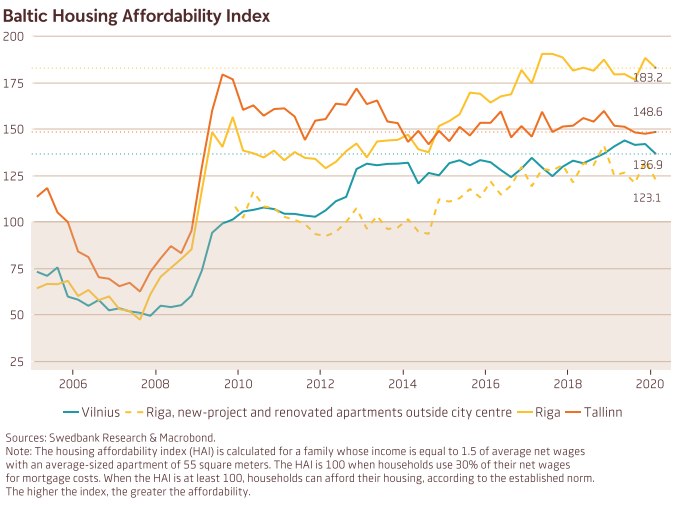

Print versionThe affordability of dwellings in the first quarter of this year improved in Riga, while slightly deteriorated in Tallinn and Vilnius, the Baltic housing affordability index published by Swedbank indicates.

At the start of 2020, the housing market in the Baltics was still unfazed by the pandemic. Overall housing affordability was high in all the capitals as wages and real estate prices grew hand in hand. However, housing affordability in Tallinn and Vilnius decreased in the first quarter, compared with the same period of 2019, as apartment price growth outpaced wage growth. In Riga, the housing affordability index (HAI) value increased as wages grew more rapidly than apartment prices. The COVID-19-induced economic shock will affect the housing market negatively, but sustainable growth during the past decade, low leverage and ample money supply mean that the price drop is likely to be modest and short-lived.

In Tallinn, price growth accelerated over the year to 8.3%. The growth was

driven by the large share of newly built apartments and the completion of

developments in the luxury apartments segment. In February, the growth

in activity was very strong: the number of transactions rose by 19%

annually. However, a sharp decline in the second half of March dragged

volumes of the first quarter to -1% over the year. According to preliminary

data, the number of transactions decreased by 43% in April and 36% in May

annually. Despite the sharp decline in housing demand, the average price

growth is driven by the completion of new developments.

In Riga, price growth slowed down a bit over the year and reached 5.4%.

That was due to diminishing price growth of older Soviet-era apartments

that still dominate the market. The price growth of the new-project and

renovated apartments outside the city centre was 9%. The drop of

transactions (mainly secondary market) occurred in April and May, while

transactions with new apartments still took place upon the previously

made agreements.

In Vilnius, for the first time volumes of new development sales were larger

than those of old apartments. The first two months of the year were

uncharacteristically active. These two factors meant that apartments were

appreciating at the average rate of 12% in the first quarter, despite

quarantine starting in mid-March. Even though housing market was

completely frozen for the last couple of weeks of the quarter, transaction

volume increased by 11.5 % annually.

In the beginning of 2020, net wage growth in Vilnius and Riga moderated

to 9.2% and 5.5%, respectively, compared with the previous year, while

in Tallinn it slightly accelerated to 6%. Net wage growth eased in Vilnius

as the boost from the tax reform faded; however, the underlying

earnings gains strengthened even further, especially in the private

sector.

In Riga, wage growth remained rather strong, with moderation in

the first quarter led by the private sector. In Tallinn, wage growth was

supported by rapid wage growth for the IT sector and other professionals

with high qualifications, most of whom are concentrated in the capital.

The first quarter showed only the first signs of the pandemic’s impact on

the labour market in the Baltics – many workers were furloughed, and

unemployment started rising. Deteriorating labour market conditions

will stop the rapid wage growth across the Baltics. However, an outright

contraction is unlikely, since the public sector wages are not expected to

be cut: in some cases, private sector raises were already locked in, and,

e.g., in Estonia and Lithuania the minimum wage was increased.

Overall,

we are more likely to see a reduction in working hours and employment

rather than straight-up wage cuts. Furthermore, the average wage level

will be propped up because it is the low-wage sectors experiencing the

largest layoffs.

In the first quarter, the number of months needed to save for a down

payment, which equals 15% of an apartment price, increased in Vilnius

and Tallinn; it did not change in Riga. In Tallinn, it was 29 months. In

Riga, it was 23.7 months (35.2 months for new-project and renovated

apartments). In Vilnius, it was 32.5 months.

It is too early to evaluate the development of housing market and housing

affordability in 2020, as the effect on housing prices will be delayed.

Transactions with newly built apartments are reflected in data with a

significant lag from the time of signing the purchase agreement; this will

help maintain the upward price momentum in data for some time.

The much healthier household and corporate finances than 12 years ago

mean both the households and corporates have the luxury to play the

waiting game. Few potential sellers are so financially distressed to dump

flats at a significant discount; however, some cases of discount selling

might appear as the recovery is expected to be slow, with some sectors

suffering for a prolonged period. Developers are postponing construction

in reaction to the worsening outlook. The only area where price correction

is already under way is the rental market, especially in prime locations, as

apartments used for short-term rent for tourists have relocated to the

long-term market. It remains to be seen if contagion will spread.

Contrary to 12 years ago, the housing market in the Baltics is developing

in a sustainable manner. Housing was not overvalued; affordability was at

a record high. Of course, given the severity of the economic shock, some

downward correction in real estate prices is expected, although much less

severe. Overall, we expect housing prices to fall up to 10% by the end of

the year and start growing again in 2021.

The housing market will be affected through both – the impact on

demand and supply. While, in the beginning of the quarantine,

purchases were delayed mainly due to imposed restrictions, as well as

heightened uncertainty, the deteriorating financial situation and weak

consumer confidence means that many households will refrain from

buying homes further ahead as well.

Other articles:

- 25.01.2021 Как банкиры 90-х делили «золотую милю» в Юрмале

- 30.12.2020 Hotels showing strong interest in providing self-isolation service

- 30.12.2020 EU to buy additional 100 mln doses of coronavirus vaccine

- 30.12.2020 ЕС закупит 100 млн. дополнительных доз вакцины Biontech и Pfizer

- 29.12.2020 В Латвии вводят комендантский час, ЧС продлена до 7 февраля

- 29.12.2020 В Rietumu и в этот раз создали особые праздничные открытки и календари 2021

- 29.12.2020 Latvia to impose curfew, state of emergency to be extended until February 7

- 29.12.2020 Lithuanian president signs 2021 budget bill into law

- 29.12.2020 Президент Литвы утвердил бюджет 2021 года

- 29.12.2020 В Риге можно изолироваться в трех гостиницах

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!