Analytics, Budget, Financial Services, GDP, Lithuania

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 07:05

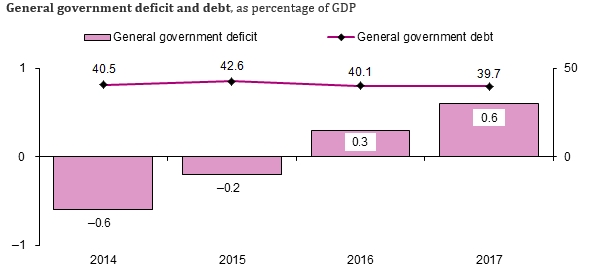

In 2017, general government surplus stood at 0.6, debt – 39.7% of GDP in Lithuania

Print version

Print versionIn 2017, general government revenue amounted to EUR 14 billion 177 million, expenditure – EUR 13 billion 925 million. The general government surplus was determined by a 6.4% increase in revenue. Tax revenue amounted to EUR 7 billion 179 million, or 50.6% of the total general government revenue. Against 2016, it increased by 6.7% (EUR 450.6 million). Social contributions amounted to EUR 5 billion 300 million, or 37.4% of the total general government revenue. Against 2016, it increased by 9.4% (EUR 456.3 million).

Over the year, general government expenditure increased by EUR 698.2 million, or 5.3%. The bulk of the general government expenditure consisted of expenditure on social protection, education and health care.

In 2017, the central government deficit amounted to EUR 34.7 million, or 0.1% of GDP, the local government surplus – EUR 86.7 million, or 0.2% of GDP, the surplus of social security funds – EUR 200.6 million, or 0.5% of GDP. In 2017, the central government deficit decreased by EUR 69.9 million. In 2017, the local government surplus decreased by EUR 105.1 million, the surplus of social security funds – increased by EUR 184.8 million.

In 2017, the general government debt increased by EUR 1 billion 118 million, and at the end of the year amounted to EUR 16 billion 631.7 million at nominal value, or 39.7% of GDP (EUR 5.9 thousand per capita).

At the end of 2017, the general government consolidated debt comprised the central government debt (EUR 16 billion 84 million) and local government debt (EUR 548 million). The non-consolidated debt of the central government amounted to EUR 16 billion 84 million, of the local government – EUR 577.9 million, of social security funds – EUR 3 billion 682 million. The main consolidated sum is the central government loan to social security funds (at the end of 2016, the balance amounted to EUR 3 billion 682 million). The bulk of the general government debt consisted of outstanding securities – EUR 13 billion 880 million (83.5% of the total debt).

Outstanding loans at the end of the year amounted to EUR 2 billion 331 million, deposits (savings certificates) – EUR 420.6 million.

In 2017, the long-term debt accounted for 99.4%, the short-term debt – for 0.6% of the general government debt. Over 2017, the long-term debt increased by EUR 1 billion 171 million and at the end of the year stood at EUR 16 billion 527 million; the short-term debt decreased by EUR 52.9 million and at the end of the year stood at EUR 102.1 million.

The main components and dynamics of the general government deficit and debt, EUR million

|

|

2014 |

2015 |

2016 |

2017 |

|

Deficit (-) / surplus (+) |

–225.8 |

–91.6 |

103.0 |

252.6 |

|

central government subsector |

185.6 |

–213.2 |

–104.6 |

–34.7 |

|

local government subsector |

43.7 |

122.4 |

191.8 |

86.7 |

|

social security funds subsector |

–455.1 |

–0.8 |

15.8 |

200.6 |

|

Deficit-to-GDP ratio, % |

–0.6 |

–0.2 |

0.3 |

0.6 |

|

General government

consolidated gross debt at nominal value outstanding at the end of the year |

14 825.0 |

1 5939.5 |

15 513.7 |

16 631.7 |

|

Currency and deposits (savings certificates) |

304.9 |

533.4 |

541.4 |

420.6 |

|

Debt securities |

11 725.8 |

12 530.0 |

12 277.8 |

13 880.5 |

|

short-term |

208.0 |

0.0 |

0.0 |

0.0 |

|

long-term |

11 517.8 |

12 530.0 |

12 277.8 |

13 880.5 |

|

Loans |

2 794.3 |

2 876.1 |

2 694.5 |

2 330.6 |

|

short-term |

456.3 |

322.8 |

3.1 |

2.4 |

|

long-term |

2 338.0 |

2 553.3 |

2 691.4 |

2 328.2 |

|

Debt-to-GDP ratio, % |

40.5 |

42.6 |

40.1 |

39.7 |

|

GDP (at current prices) |

36 568.3 |

37 426.6 |

38 668.3 |

41 857.0 |

Following the ESA 2010 requirements, each year, before 1 April, Statistics Lithuania, in cooperation with the Ministry of Finance of the Republic of Lithuania, prepares an excessive deficit procedure (EDP) notification and provides it to the European Commission. According to the results of this notification, the State's conformity to the criterion of sustainability of the government financial position is assessed. As soon as the European Commission approves the notification, it is published to the users. The 2017 EDP notification will be published on 20 April. Historical data from 1995 will be also provided. Currently, the Official Statistics Portal provides general government finance statistics for 2017 which can be revised on 20 April after the revision of the EDP notification by the European Commission.

The Statistical Office of the European Union (Eurostat) will publish the results of the 2017 EDP notifications of all the EU member states on 23 April 2018.

Concepts

General government sector refers to a sector covering institutional units financed by compulsory payments, whose main activity comprises the provision of non-market services and/or redistribution of national income and wealth. General government sector includes entities financed from the State, municipal and social security funds' budgets, as well as non-budget funds and other non-market producers (part of public institutions and enterprises controlled by the State and municipalities).

General government deficit (-) / surplus (+) refers to general government revenue minus expenditure. These indicators are calculated pursuant to the requirements for excessive deficit procedures, which are based on the provisions of the European System of National and Regional Accounts (ESA 2010).

General government debt is the total gross debt at nominal value outstanding of the general government sector at the end of the year, measured on a consolidated basis, i.e. excluding debts owed to a creditor that is also belonging to the general government sector. The categories taken into account in determining the general government debt are the following: currency and deposits, debt securities and loans. The value of the unfulfilled liability at the end of each period is its nominal value.

More information on the issue is available on the Official Statistics Portal.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!