Analytics, Banks, EU – Baltic States, Financial Services, Latvia, Rating

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 19:56

High-profile conduct incidents shake Latvia’s banking system, a credit negative

Print version

Print versionThe ABLV announcement followed the ECB on 19 February

halting all withdrawals from the bank after the US Treasury’s Financial Crimes

Enforcement Network on 13 February found that ABLV had been involved in

transactions with North Korea in 2017 and had “institutionalized” money

laundering. The findings prompted customers to withdraw funds from the bank,

creating a liquidity shortage. The Central Bank of Latvia subsequently granted

ABLV €297.5 million in emergency loans, short of the €480 million that ABLV had

applied to borrow.

Separately, Central Bank Governor Ilmars Rimsevics was detained earlier this month in an

anti-corruption investigation and is currently prohibited from conducting his

duties as governor.

Before ABLV’s failure, the bank proceeded with a planned €80

million repayment of two maturing bonds on 22 February, in an attempt to avoid

a default on its obligations. The repayments are to be held in accounts at other

banks.

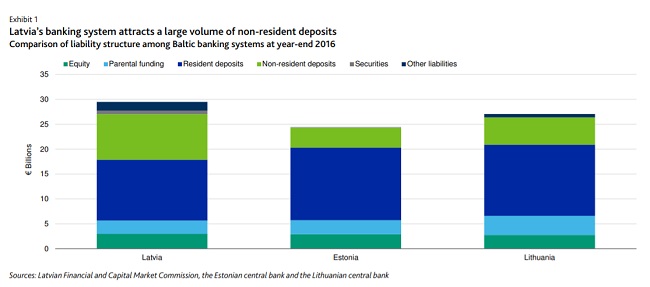

Latvia’s banking system mainly comprises two groups of

banks. One group is funded through domestic deposits and their Nordic parent

banks, which primarily lend to domestic borrowers. The other is primarily

funded through non-resident deposits and has limited domestic lending.

Approximately 30% of the banking system’s liabilities are made up of

international non-resident deposits (see Exhibit 1), a significant margin over

other Baltic states (Estonia and Lithuania), which makes Latvia’s banking system

vulnerable to negative external perceptions.

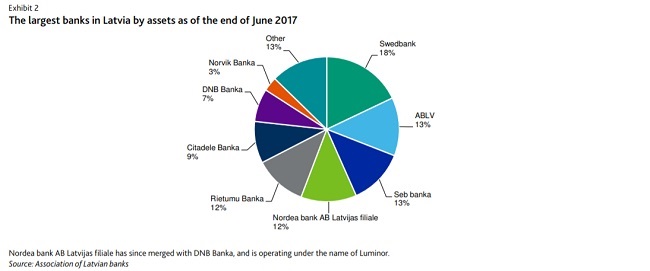

Although the developments are credit negative for all banks,

those that rely more heavily on non-resident deposits to fund their operations

are the most vulnerable, including ABLV, Rietumu

Banka, and Norvik Bank (see

Exhibit 2). ABLV’s deposits from residents in the Commonwealth of Independent

States (CIS) comprised 83.9% of deposits at 30 June of 2017. Rietemu Banka has limited disclosures on

non-resident deposits, but its business model is geared toward affluent

international individuals, and as of year-end 2016 62% of its total lending was

to borrowers in countries that are not part of the Organisation for Economic

Co-operation and Development (OECD), which we believe infers a high degree of

non-resident deposits. Norvik Bank’s

non-resident deposits were 57.8% from non-OECD countries at year-end 2016,

including 25.3% from Russia.

Among the Latvian financial institutions we rate, SC Citadele Banka (Ba2 positive, b11 )

and JSC Development Finance Institution Altum

(Baa1 stable) are well positioned to withstand pressure that could arise

from these events. Citadele in recent

years has grown primarily in Baltic countries, focusing on consumer and small

and midsize enterprise lending, while meaningfully reducing exposures to

countries that comprise the Commonwealth of Independent States (CIS) and being

restrictive in accepting new non-resident deposits. At the end of December

2017, its deposits from Baltic countries were 64% of total deposits, while

deposits from CIS countries were 7.6%, and liquid assets over tangible banking

assets exceeded 52%. Altum is a

development institution mainly funded by state and European Union programmes.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!