Analytics, Baltic Export, Direct Speech, Industry, Latvia, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Tuesday, 23.04.2024, 13:03

Export momentum supports manufacturing in Latvia in H1

Print version

Print versionManufacturing

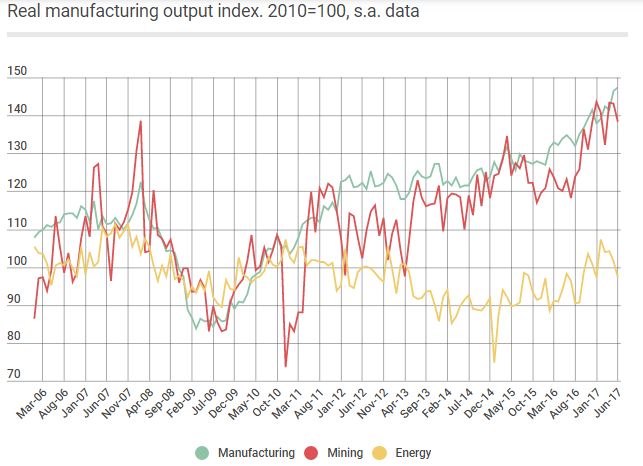

output in June 2017 rose both month-on-month and year-on-year, by 0.7%

(seasonally adjusted data) and 10.1% (working-day adjusted data) respectively.

The first half of the year was very successful overall –7.9% year-on-year

growth. The other two branches of industry posted a slight drop in June. In the

energy branch the entire second quarter was, as predicted, somewhat worse than

the first, whilst overall in the first six months growth of 12.6% was observed.

Barring monthly fluctuations, mining and quarrying is spending the year on the

wave of construction recovery, registering an increase of 16.5% in the half of

the year.

It is

often said that recent manufacturing growth has mostly taken place due to

global growth. Recovery is indeed observed in the global environment and the

turnover results of Latvian manufacturing confirm this observation. In the

first six months, export turnover rose by 11.9% while turnover in the domestic

market increased by only 4.3%. The share of manufacturing turnover that is exported

has increased by almost 15 percentage points since 2008. If 10 years ago it

represented about one half, then in 2016 it was already 65% of production.

Judging by the data of the first six months, export markets have become even

more important this year.

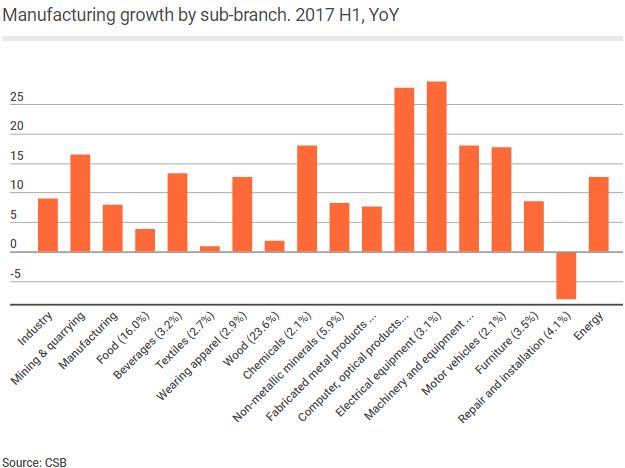

The largest sub-branch, wood industry, which produces almost one fourth of total manufacturing output, is also among the active exporters: three quarters of what has been produced is exported. This year so far has not been as good for the sub-branch as the previous ones, however. After a promising performance in May, wood industry output unfortunately dropped in June both month-on-month and year-on-year. On the one hand, preliminary indicators for the third quarter demonstrate that both the assessment of new orders by the industry as well as the duration of production assured by current order-book levels have increased. Yet the current level of capacity utilization (82.5%)is very close to the all-time maximum. This serves as an indication that, barring further investment, fast growth in wood industry will be unattainable.

The recently fast-growing high technology sub-branches are also amongst those most reliant on exports: about 90% of the output is exported. In all these sub-branches, an impressive two-digit growth was observed in the first six months.

Food production, which, in recent years, has had its share of woe, picked up in the first half of this year, posting a staggering 10.1% rise year-on-year in June. Overall, export markets are not as important for the food manufacturing as they are for the above-mentioned sub-branches – only about one third of the production is exported. Yet export turnover has been growing noticeably since mid-2016. It means that our food manufacturers are becoming increasingly active in acquiring export markets. For this branch, too, the amount of orders has increased, pointing to continued growth in the industry in the near future.

Judging

by the confidence indicators aggregated by the European Commission, manufacturers

are increasingly less likely to mention demand as a factor limiting production.

However, if not too long ago we were happy to note that an increasing number of

enterprises do not see any factors limiting production, we must admit that it

is no longer the case. Lately, shortages of labour and equipment are being

mentioned more and more often.

Under

the conditions of faster construction growth, shortage of employees will become

an even more acutely felt problem in manufacturing. The competition for employees

will become more aggressive - offering faster-increasing salaries and better

working conditions. This of course will benefit employees, yet it will harm the

cost competitiveness of producers. Even though it is the momentum in the export

markets that currently underpins manufacturing growth, a rise in global demand

is hardly enough. To be able to meet future challenges, productivity will have

to rise.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!