Analytics, Banks, Latvia

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 06:29

Moderate growth continues in the monetary sector

Print version

Print version |

|---|

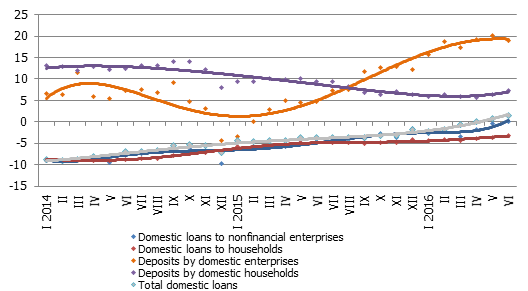

The balance of domestic loans increased in June by 0.1%, with the loans granted to nonfinancial enterprises increasing by 0.1%, loans to financial institutions by 1.4% and consumer loans to households by 0.5%. Only loans for house purchase slightly dropped. The rate of annual rise in total domestic loans reached 1.4%, and in June it turned positive also for loans to nonfinancial enterprises (+0.02%), remaining below zero (-3.3%) only for loans to households.

The domestic deposits attracted by banks increased in June by 0.8%, with the rate of their annual growth at 12.4%. Household deposits increased by 1.7% (rate of annual growth 7.3%), and enterprise deposits dropped by 0.3% (annual growth in June 18.9%).

With deposits growing and the demand for cash virtually unchanged, the Latvian contribution to the euro area total money supply indicator M3

increased. The overnight deposits by euro area residents with Latvian

credit institutions rose in June by 1.5% and deposits redeemable at

notice by 0.8%, whereas deposits with the set maturity of up to two

years shrank by 0.8%. Overall, the Latvian contribution to the euro area

M3 increased by 1.1%, growing by 11.6% year-on-year.

Y-y changes in some money indicators (%)

Source: Latvijas Banka

The renewed increase in lending, albeit small, and the

maintenance of a moderate rise in deposits characterize the overall

stability that is observed in the Latvian economy. Even though

fundamental changes are not expected in these trends, we must note some

factors that influence them. Among those, is an interruption in the

availability of European Union (EU) structural funds, which hinders the

lending to construction projects, yet one reason for hope is the stable

progress observed regarding the readiness to begin investing, according

to the informative report of the Ministry of Finance on the status of EU

fund investment introduction. Another is the allotment of additional

funding for the housing support programme adopted by the government at

the beginning of July, which gives rise to a more positive view of

lending to households. The expected exit of the United Kingdom from the

EU, on the other hand, means increased uncertainty and possible

postponement of investments in the shorter and medium term.

www.macroeconomics.lv/moderate-growth-continues-monetary-sector

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!