Analytics, Baltic, Financial Services, Real Estate, Wages

International Internet Magazine. Baltic States news & analytics

Friday, 19.04.2024, 15:35

Housing affordability in Riga still the highest among the Baltic capitals in Q1

Print version

Print version

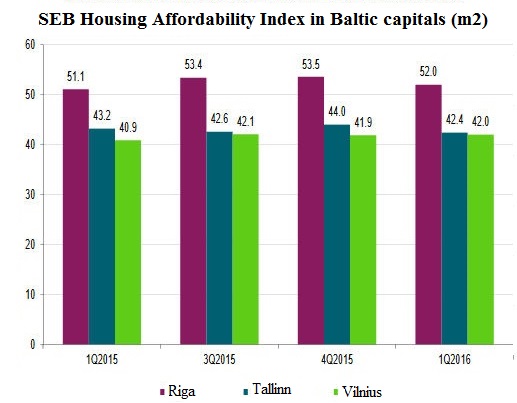

Although the value of the SEB Housing Affordability Index (HAI) dropped in the first quarter of this year, the affordability of standard-design apartments in Riga still remained the highest among the Baltic capitals. Also, in comparison with the first quarter of 2015, the HAI rose in Latvia and Lithuania but dropped in Estonia.

Over the past year, the HAI grew at the steepest rate in Vilnius where housing affordability increased by 1.1 square meters. By comparison, housing affordability in Riga increased by 0.9 square meters and in Tallinn the index decreased by 0.8 square meters on year.

This means that an employed person earning average the average wage and spending 30% of the monthly income on a 25-year mortgage loan can afford to buy a 42.5 square meter large apartment in Tallinn, a 42 square meter large apartment in Vilnius and a 52 square meter large apartment in Riga.

“The working population’s real income grew in all three Baltic states over the year. Statistics show a slowdown in wage growth in Latvia, whereas in Lithuania and Estonia annual wage growth has picked up against previous quarters. At the same time, Latvian housing prices have been growing at a slower pace than in the neighbor countries,” said SEB Banka household economist Edmunds Rudzitis, adding that housing affordability in Riga continued to improve in the last 12 months as housing prices rose at slower than people’s real income.

The SEB Housing Affordability Index shows the maximum floor space a resident with average income can afford on a bank loan without taking excessive risks. The index is based on four factors affecting the housing market – real estate prices, average wage, inflation and loan interest rates.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!