Analytics, Baltic States – CIS, EU – Baltic States, Investments, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Thursday, 25.04.2024, 23:52

Number of new direct investment projects grows in Europe, drops in Latvia

Print version

Print version

The survey shows that among the Baltic States, Lithuania saw the biggest number of new direct investment projects (43) seeing a slight growth in investments. The number of new direct investment projects has dropped in Latvia from 36 in 2014 to 31 last year, while in Estonia the number of new projects was 22.

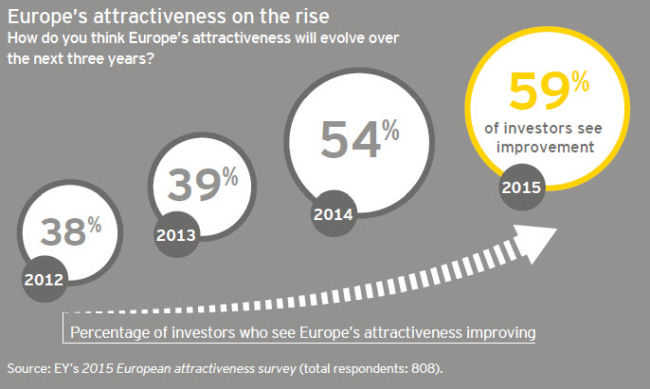

"We see that Europe is attracting more direct investments even at times when its economic growth is slow and there is the refugee crisis and terrorism threat on the agenda. It proves that investors prefer economic stability, the market capacity, the quality of infrastructure and laborforce even at restless times," said EY partner in the Baltics, Guntars Krols.

The EY survey shows that 51% of all new direct investments projects in Europe are attracted by three countries – the UK, Germany and France, at the same time, Western Europe dominates in implementation of direct investment projects with 77% of all new implemented projects.

A number of Central and Eastern European countries demonstrate a strong growth in new projects – Russia (61%), Poland (60%).

At the same time, the number of new projects in Latvia dropped from 36 to 31 last year, and the number of new workplaces created by these projects has declined from 1,525 workplaces in 2014 to 725 workplaces last year. The indicators, however, are better than in the time period between 2009 and 2013.

"Latvia’s results are not bad, but the government should carefully revise the economic and political predictability offered to investors, the quality of infrastructure and laborforce. Latvia will not be able to compete with Poland or Hungary with the size or capacity of the market, therefore other issues are of even more importance," said Krols.

The EY Europe Attractiveness Survey is based on EY Global Investment Monitor (GIM). This database tracks those foreign direct investment (FDI) projects that have resulted in the creation of new facilities and new jobs. By excluding portfolio investments and mergers and acquisitions, it shows the reality of investment in manufacturing and services by foreign companies across the continent.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!