Analytics, Economics, EU – Baltic States, Financial Services, GDP, Inflation, Markets and Companies

International Internet Magazine. Baltic States news & analytics

Wednesday, 24.04.2024, 06:47

Economic outlook for the euro area in 2016 and 2017

Print version

Print version

The report provides updated forecasts and analyses of the macroeconomic situation for the Euro area.

The Highlights of this Report are:

* Global growth will stay rather moderate this year. The peak of the upswing in the US appears to be over. For Japan, after three years of “Abenomics”, a prolonged upswing is still elusive. In China low profitability and high debt levels of many government-owned industrial firms continue to drag growth down.

|

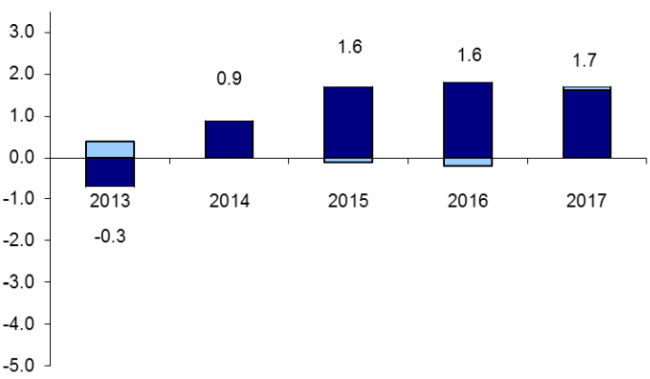

| Contributions of domestic components and net exports to GDP growth |

* The low prices for commodities heighten uncertainty and volatility on financial markets since they increase the risks of financial crises in economies that are dependent on commodity exports.

* In the euro area, chances for the recovery to continue are good, as this year, like in 2015, oil prices will probably be markedly lower than they were a year ago, supporting real income of private households and lowering production costs of firms.

* In this context, our forecast is that euro area GDP will expand by 1.6% in 2016 and by 1.7% in 2017. These rates are higher than the rate of potential growth, but they are arguably low given the expansive monetary policy and the strong stimulus from decreased commodity prices.

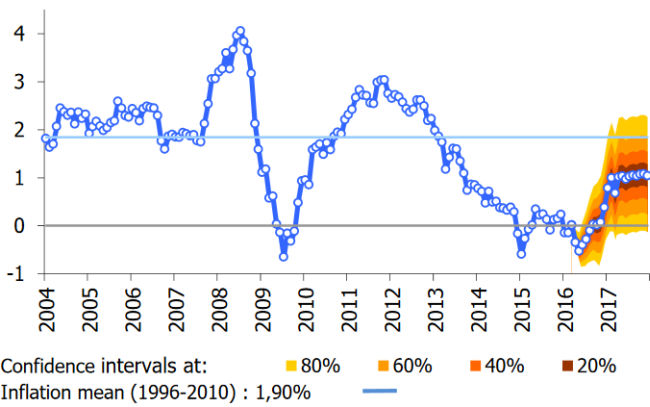

* We do not expect an increase in euro area inflation during 2016, but prices will grow by around 1% in 2017, because the dampening effects of decreasing energy prices slowly fade off and the euro remains rather weak.

|

| HICP and confidence bands |

*

However, risks for this cautiously optimistic forecast are substantial. New

shadows on the financial sector, the uncertainty about whether or not the

British will vote in favour of membership in the European Union and the lack of

a viable political solution for the refugee crisis are some of the main

uncertainties behind these forecasts.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!