Analytics, Economics, Education and Science, EU – Baltic States, Financial Services, GDP, Inflation

International Internet Magazine. Baltic States news & analytics

Friday, 26.04.2024, 01:30

European Forecasting Network presents economic outlook for the euro area in 2015 and 2016

Print version

Print version

The report provides updated forecasts and analyses of the macroeconomic situation for the Euro area.

|

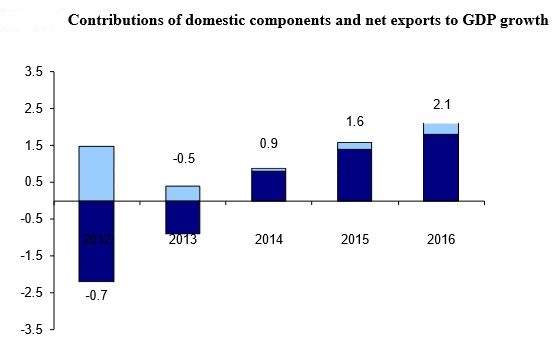

| Domestic demand dark, net exports light area. Percentage points, figures above or below the columns indicate overall GDP growth |

The Highlights of this Report are:

· At recent movements on world markets for commodities, currencies and capital stimulate the world economy, but they entail also considerable risks: income losses of energy exporting countries might trigger financial crises with worldwide repercussions; crises might also emerge from financial distress of emerging market debtors with liabilities denominated in US dollars. Extremely low interest rates might not only trigger stock and bond price booms, but also more volatility if investors become fearful of financial bubbles.

· Quite a few conditions are highly beneficial for a recovery of the euro area economy: governments and large corporations benefit from ultra-low bond yields, banks’ composite costs of debt financing have been converging during the past two years to very low levels, and borrowing costs for non-financial corporations have come down markedly. Prices for stocks, bonds and (on average) houses have gone up. Real disposable incomes of private households have risen due to oil prices. The real effective exchange rate is about 10% lower in March 2015 than it was a year ago, strengthening the price competitiveness of firms in the euro area.

· According to our forecasts, the euro area GDP will grow by 1.6% in 2015 and by 2.1% in 2016. Structural impediments, however, still limit the ability of the euro area economy to grow strongly: firms and, in particular, private households are only slowly reducing their heavy debt burdens, and confidence will not fully come back in France and Italy, as long as reform processes are inconclusive in both countries and as long as unemployment is not coming down markedly.

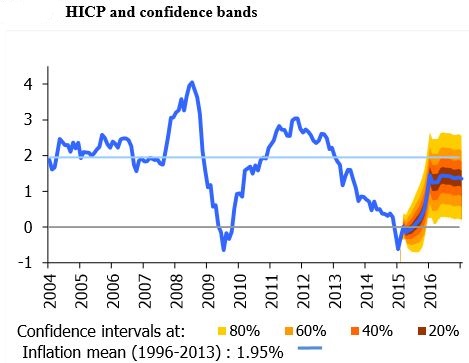

· Our inflation forecast for 2015 is 0.1%, with the possibility of a mild deflation not excluded. In 2016 inflation will increase up to 1.3%, still clearly below the 2% ECB’s target. This calls for continued monetary expansion, though its effects could be limited in the absence of a complementary fiscal stimulus, in particular in those countries where the implementation of structural reforms brings long term gains but short term losses.

The full report is available here.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!