Analytics, EU – Baltic States, Investments, Lithuania, Markets and Companies, Rating, Technology

International Internet Magazine. Baltic States news & analytics

Tuesday, 16.04.2024, 12:03

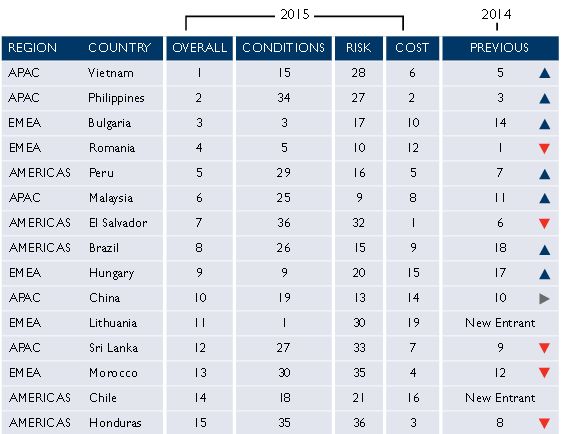

Lithuania 11st globally for conditions for Business Process Outsourcing in 2015

Print version

Print version |

|---|

Latvia and Estonia are not included in the rating.

Lithuania took the top position in the business conditions category, which judged countries on four criteria; the availability of top talent, the business environment, the quality of the IT infrastructure and the time taken up to the first supply. The second and third positions were taken by the Netherlands and the United Kingdom.

According to analysts at Cushman & Wakefield, Lithuania offers stronger long-term growth and expansion prospects for businesses than its neighbours. "Despite being a firmly established market, Lithuania still has low saturation levels in comparison to some of its neighbours, which provides companies with better prospects for sustainable growth. The attractiveness of Lithuania's BPO market has steadily grown since 2008, as shown by the fourteen-fold increase in investment from 2008-2013."

Significantly, the report points out that Lithuania‘s attractiveness has been increasing steadily over the last few years, with inward investment in the sector rising 82% from 2010-2013. „An influx of companies sought access to the country‘s highly proficient English speaking workforce, available at a competitive cost to quality ratio. Such conditions have drawn high profile global companies, such as Barclays and Western Union“, states the report.

For Mantas Katinas, Managing Director at Invest Lithuania – a government agency that promotes foreign investment – the business conditions Lithuania has to offer mean it is becoming a major hub for BPO in the region: „According to data from the European Commission, almost every young professional in Lithuania is fluent in English. Moreover, about two thirds of the country‘s talent pool are proficient in Russian. SSC‘s in Lithuania provide services to clients in as many as 28 different languages.”

These high levels of language skill, coupled with Lithuania’s state of the art ICT infrastructure, provide outstanding opportunities to foreign businesses. Lithuania is home to Western Union‘s centre of excellence and Barclays IT and HR centres. Nasdaq, Lindorff, Intermedix and Danske also have substantial SSC&BPO centres in the Baltic country.

Earlier this year, Lithuania’s attributes in SSC and BPO were also recognised at the Central and Eastern Europe Shared Services and Outsourcing Awards, where Lithuania’s shared services sector won in three major categories. Vilnius, the capital, won “best city of the year”, Kaunas, the country’s second city, won the award for “emerging city of the year”, and Barclays Technology Centre in Vilnius was crowned the best service centre in Central and Eastern Europe (CEE). Alongside the award winners, the short list of 27 nominations included six other companies from the Lithuanian shared services sector; Danske Bank, SEB, Western Union, Ahlstrom Vilnius, Storebrand Baltic, Barclays and Intermedix.

Last year, Cushman & Wakefield recognised Lithuania’s potential in its Manufacturing Index. In the category of “High Growth Locations,” Lithuania came in 3rd position ahead of Bulgaria, the Czech Republic, Hungary and Slovenia.

The Business Process Outsourcing and Shared Service Location Index evaluates 36 countries globally, based on a wide range of criteria that are separate into three categories: business conditions, risks and costs. The choice of countries is based on fDi Markets data on the largest recipients of FDI in the sector in recent three years, up to Q3 2014.

«The Baltic Course» Is Sold and Stays in Business!

«The Baltic Course» Is Sold and Stays in Business!